Introduction

Investing in the stock market can be both exciting and nerve-wracking, especially when it comes to volatile stocks like Unitech Limited. In this article, we will take a deep dive into the latest updates and analysis of Unitech share price.

Unitech Limited: A Brief Overview

Founded in 1972, Unitech Limited is one of India’s leading real estate developers. The company has a diverse portfolio of residential, commercial, retail, and hospitality projects across the country. Unitech has faced its share of controversies and challenges over the years, including a significant impact from the global financial crisis of 2008 and legal battles related to allegations of fraud and mismanagement. These factors have had a direct influence on the company’s stock price performance.

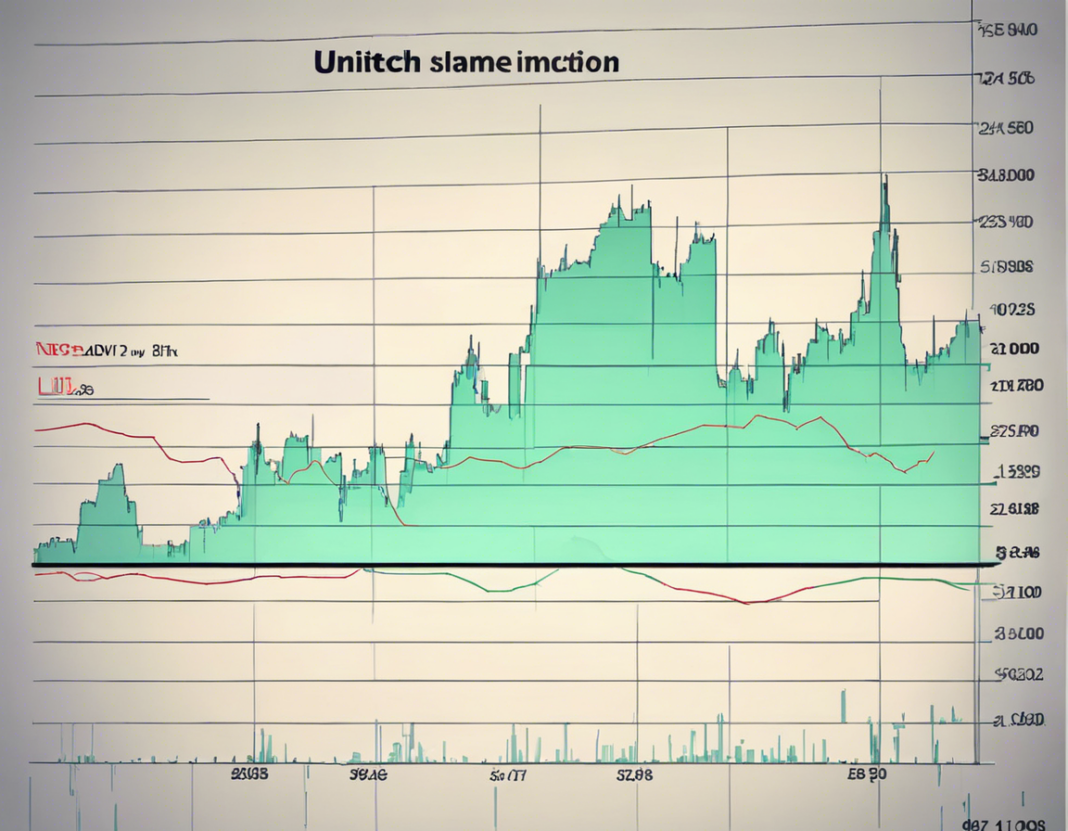

Unitech Share Price Performance

Unitech’s share price has been subject to significant fluctuations in recent years. The stock experienced a sharp decline following the global financial crisis in 2008, and its recovery has been slow and turbulent. Various factors, including market dynamics, regulatory interventions, and internal challenges, have influenced Unitech’s share price movement.

Latest Updates on Unitech Share Price

As of [current date], Unitech’s share price stands at [current share price]. The stock has shown [upward/downward/stable] movement in the past [time period], reflecting the [current market sentiment/trends]. Earnings reports, industry developments, and macroeconomic factors can all impact the stock’s performance.

Factors Influencing Unitech Share Price

Several key factors can influence the movement of Unitech’s share price, including:

- Market Sentiment: Investor perception of Unitech’s prospects and the overall real estate sector can drive buying or selling activity.

- Earnings Performance: Quarterly and annual financial results play a significant role in determining the stock’s valuation.

- Regulatory Environment: Changes in regulations related to real estate development and corporate governance can affect investor confidence.

- Competitive Landscape: Unitech’s position relative to its competitors and market dynamics can impact its share price.

- Macroeconomic Indicators: Economic trends, interest rates, and inflation rates can influence investor decisions.

Analyst Recommendations and Outlook

Analysts often provide recommendations and forecasts for Unitech’s stock based on various factors. These recommendations can range from “Buy,” “Hold,” to “Sell,” and are accompanied by price targets and rationales. Investors should consider analyst opinions along with their own research before making investment decisions. The outlook for Unitech’s share price will depend on a combination of internal and external factors, as well as broader market conditions.

Risks and Challenges

Investing in Unitech stock comes with its own set of risks and challenges. These may include:

- Regulatory Risks: Legal and regulatory challenges facing the company could impact its operations and financial performance.

- Market Volatility: Real estate stocks are subject to market fluctuations, and Unitech is no exception.

- Company-Specific Issues: Internal governance, debt levels, and project delays can all affect Unitech’s stock performance.

- Industry Trends: Changes in the real estate sector, such as demand-supply dynamics and pricing trends, could influence Unitech’s prospects.

Investment Strategies for Unitech Stock

Investors looking to add Unitech stock to their portfolio should consider a few key strategies:

- Diversification: Spread investments across sectors and asset classes to reduce risk.

- Long-Term View: Real estate investments often require a long-term perspective due to the cyclical nature of the industry.

- Research and Due Diligence: Conduct thorough research on Unitech’s financials, projects, and future prospects before making investment decisions.

- Risk Management: Set clear investment goals, risk tolerance levels, and exit strategies to manage potential losses.

- Consulting with Financial Advisors: Seek advice from financial professionals or investment advisors to make informed decisions about Unitech stock.

FAQs (Frequently Asked Questions)

1. Is Unitech a good investment option?

Answer: Unitech’s stock is considered high-risk due to its volatile nature and challenges in the real estate sector. Investors should conduct thorough research and consider their risk tolerance before investing in Unitech.

2. What are some key factors to consider before investing in Unitech stock?

Answer: Key factors include the company’s financial health, regulatory environment, industry outlook, and competitive position in the market.

3. How has Unitech’s share price performed in recent years?

Answer: Unitech’s share price has experienced significant fluctuations due to various internal and external factors impacting the company.

4. What are some common risks associated with investing in Unitech stock?

Answer: Regulatory risks, market volatility, company-specific challenges, and industry trends are common risks associated with investing in Unitech stock.

5. How can investors mitigate risks when investing in Unitech stock?

Answer: Investors can mitigate risks by diversifying their portfolio, taking a long-term view, conducting thorough research, managing risk effectively, and seeking advice from financial professionals.

In conclusion, investing in Unitech stock requires careful consideration of the company’s financials, industry outlook, and market dynamics. While the stock may offer potential opportunities, it also comes with inherent risks that investors should be aware of. By staying informed, conducting due diligence, and adopting sound investment strategies, investors can make well-informed decisions regarding Unitech’s share price.