Any unamortized premium should be reported on the balance sheet of the issuing corporation as, “Premiums receivable from bondholders for a security not yet delivered.”

This will allow you to account for any premiums that have been paid in advance and are owed by your company.

The issue arises when the company does not provide a good faith estimate of what those premiums owed should be.

Let’s explore this example: You sell a bond with an unamortized premium and then for whatever reason, you never deliver them.

In that scenario, it is your responsibility to make up the difference by paying either the original purchaser or current holder the appropriate amount as agreed upon in your contract; otherwise, you will have incurred debt on behalf of your corporation without reporting it anywhere other than in these exact words (see the first paragraph).

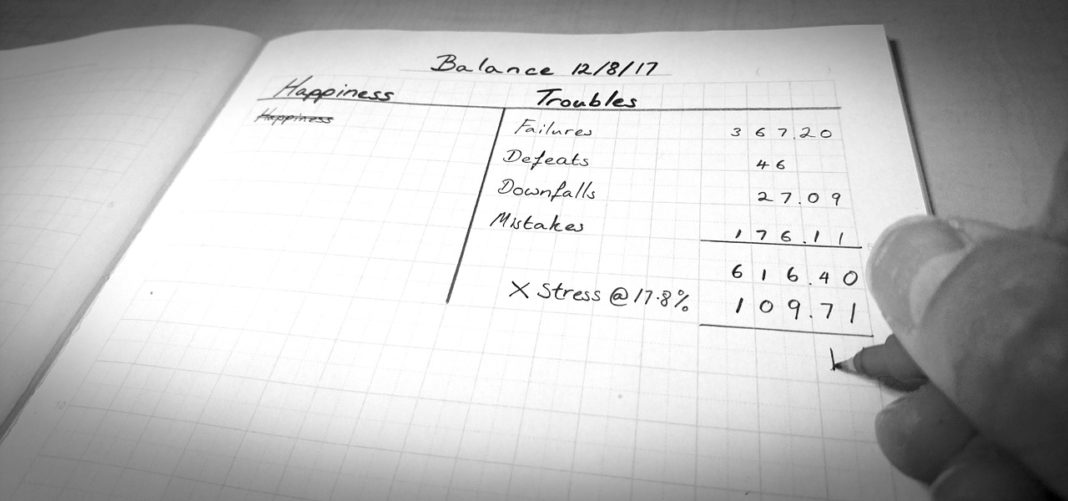

The balance sheet would look like this: Premiums receivable from bondholders for securities not yet delivered $X Liabilities payable to owners $X -Unamortized